The UK 2013 Budget – Some things you might need to know…

First the Good News……

Income tax

The personal allowance for under-65s will rise by £560 to £10,000 in 2014/15.

Housing

From 1 April, the Help-to-Buy scheme will give people who have a 5% deposit a 20% interest-free loan on homes worth up to £600,000. The qualifying period for people looking to purchase their home under the Right-to-Buy scheme has gone down to three years.

Childcare

Working families will benefit from a 20% tax relief on childcare costs, offering an annual saving of £1,200 per child under 12. The scheme will be phased in from autumn 2015.

An additional £200 million will be provided to increase childcare support in Universal Credit, with the commitment being introduced from April 2016.

Corporation Tax

Corporation tax will be reduced by a 1% to 20% in April 2015.

Employers National Insurance

Employers’ national insurance payments will be cut by £2,000 from April 2014

To take advance of the allowance, firms will simply have to inform HM Revenue & Customs, and the Treasury says it will be “delivered through standard payroll software”.

Mr Osborne added: “For the person who’s set up their own business, and is thinking about taking on their first employee – a huge barrier will be removed.”

“They can hire someone on £22,000, or four people on the minimum wage, and pay no jobs tax.”

450,000 small firms will pay no employer National Insurance.

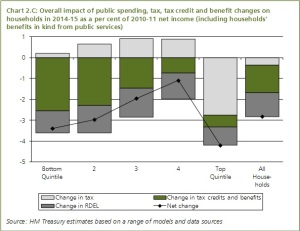

So who are the overall winners and losers – overall we are losers!

Based on Treasury analysis, the middle income families have done better than the bottom quartile and top quartile, but overall we are all worse off (based on all households).

The Economy and Borrowing are in worse shape than previously predicted

Growth forecast for 2013 halved to 0.6% from 1.2% in December

Office for Budget Responsibility (OBR) watchdog predicts UK will escape recession this year

Growth predicted to be 1.8% in 2014; 2.3% in 2015; 2.7% in 2016 and 2.8% in 2017.

The OBR predicts borrowing of £121bn this year, the same as last year, and £120bn for 2014-5

George Osborne says borrowing as a share of GDP will fall from 7.4% in 2013-14 to 5% in 2015-16

Debt as a share of GDP to increase from 75.9% in 2012-13 to 85.6% in 2016-17

http://www.bbc.co.uk/news/uk-politics-21851965

You can read the full Budget Report by clicking on this link http://cdn.hm-treasury.gov.uk/budget2013_complete.pdf

Follow Me

Follow Me