The UK 2014 Budget – A Budget for ‘Doers, Makers and Savers’

Pensions

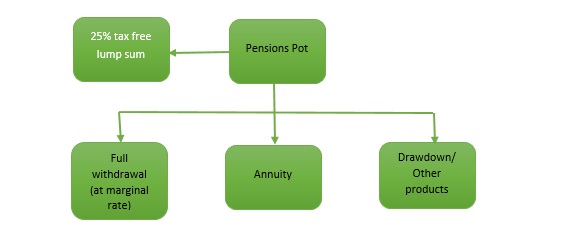

The most talked about and biggest surprise in the Budget was the announcement on changes to pensions.

Under the current system three quarters of those retiring had to buy an annuity with only very small or very large pensions having flexibility.

From April 2015 the system for accessing defined contribution pensions at retirement will be….

The news wasn’t good for Life Insurance Companies who saw £4.4m wiped off their value on the 20th March 2014.

If you do want to buy an annuity you be able to get free independent advice.

There will also be a new NS&I Pensioner Bond savings scheme to be available from January 2015 to all people over 65, paying interest rates of 2.8% for one-year bonds and 4% for three-year bonds.

From 27th March 2014 small pension pots can be cashed in, the ABI say that 25% of annuity sales related to pension pots of less that £10,000.

“Under the current tax system, people are charged 55% if they choose to withdraw all of their defined contribution pension savings at the point of retirement. This means the majority of people instead purchase an annuity and receive taxable income over the course of their retirement. Under the new system, an individual will be able to withdraw their savings at a time of their choosing subject to their marginal rate of income tax. The government anticipates that under these circumstances some people will choose to draw down their pension sooner in order to suit their personal situation. This will increase income tax revenue in the short to medium term.” – Budget Report 2014

New ISA

The New ISA, known as NISA, will have an annual investment limit of £15,000 nearly 3 times the current cash and savings ISA limit of £5,760. The Junior ISA is being increased from £3,720 to £4,000.

The changes take effect from 1st July 2014.

ISA eligibility will be extended to Peer to Peer Loans.

Personal Allowances & Tax

The Personal Allowance was increased to £10,000 from 1st April 2014. In 2015 this will increase to £10,500. Up to 10% of the allowance will be transferable between married couples and civil partners.

The HMRC Table below shows the amount of income tax and national insurance paid by year by income level.

The National Minimum Wages will increase to £6.50 in October 2014.

Employment Allowance

The Employment Allowance is available from 6th April 2014. If you are eligible you can reduce your employer Class 1 NICs by up to £2,000 each tax year.

You can claim the Employment Allowance if you are a business or charity (including Community Amateur Sports Clubs) that pays employer Class 1 NICs on your employees’ or directors’ earnings.

If your company belongs to a group of companies or your charity is part of a charities structure, only one company or charity can claim the allowance. It is up to you to decide which company or charity will claim the allowance.

You can only claim the £2,000 Employment Allowance against one PAYE scheme – even if your business runs multiple schemes.

You cannot claim the Employment Allowance, for example if you:

- employ someone for personal, household or domestic work, such as a nanny, au pair, chauffeur, gardener, care support worker

- already claim the allowance through a connected company or charity

- are a public authority, this includes; local, district, town and parish councils

- carry out functions either wholly or mainly of a public nature (unless you have charitable status), for example:

- NHS services

- General Practitioner services

- the managing of housing stock owned by or for a local council

- providing a meals on wheels service for a local council

- refuse collection for a local council

- prison services

- collecting debt for a government department

You do not carry out a function of a public nature, if you are:

- providing security and cleaning services for a public building, such as government or local council offices

- supplying IT services for a government department or local council

Personal and Managed Service Companies who pay contract fees instead of a wage or salary, may not be able to claim the Employment Allowance, as you cannot claim the allowance for any deemed payments of employment income.

Service companies can only claim the allowance, if you pay earnings and have an employer Class 1 NICs liability on these earnings.

New Childcare Scheme from Autumn 2015

A new childcare scheme will be introduced to support working families with their childcare costs.

For childcare costs of up to £10,000 per year per child, support of 20% will be available worth up to £2,000. From the first year of operation, all children under 5 will be eligible and the scheme will build up over time to include children under 12.

The scheme will provide support for families where all parents are in work and not receiving support through the Childcare Element of Working Tax Credits/Universal Credit, or where one has an income over £150,000. Support will be provided through a childcare account redeemable at any registered childcare provider.

Corporation Tax and the Annual Investment Allowance

The Main rate of corporation tax has been cut to 21% from April 2014 and will reduce to 20% from April 2015.

The Annual Investment Allowance (AIA) is available for most businesses and partnerships in the UK. Businesses can claim AIA for capital expenditure incurred on the majority of plant and machinery items. In an effort from the Government to provide more tax aid to businesses, the AIA has been doubled to £500,000 until December 2015.

You can read the full budget report here

Follow Me

Follow Me